Tax Season Resources

Helpful Tax Filing Information

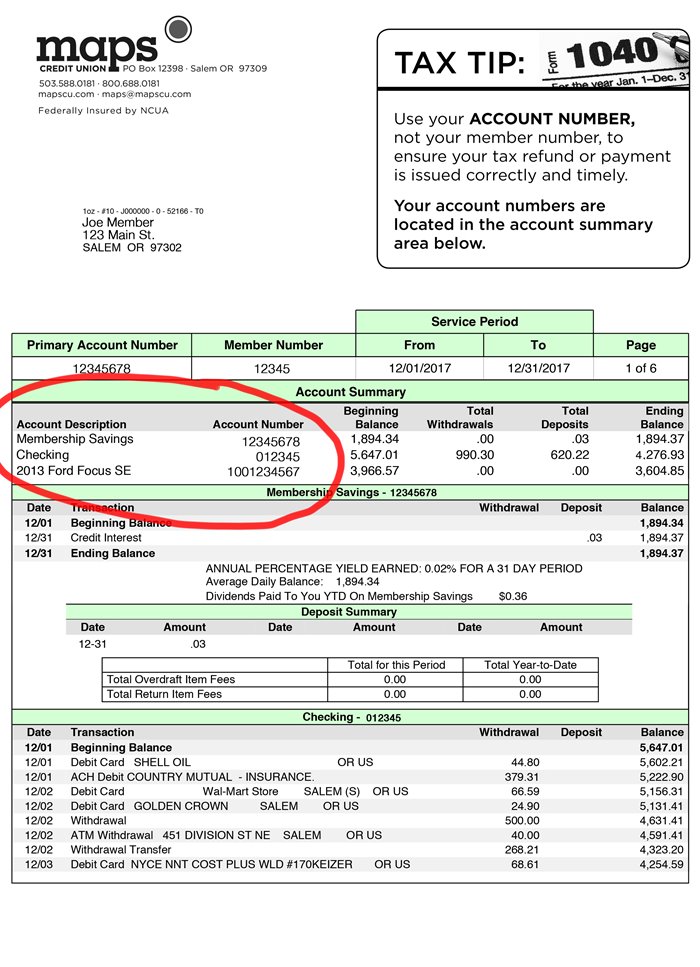

When filing your taxes, remember to use your ACCOUNT number, not your MEMBER number.

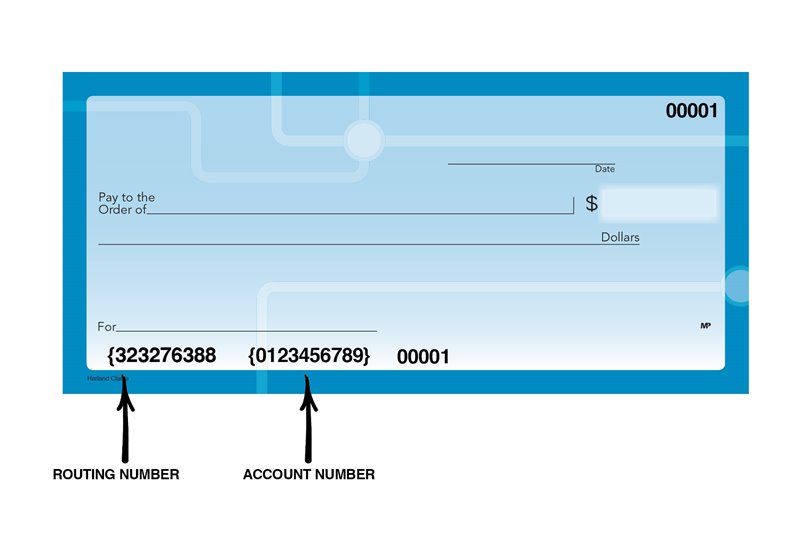

Ways to find your ACCOUNT number (detailed below):

- Paper Statement

- Online Banking or Mobile App

- Personal Check

Need the Maps Credit Union Routing Number? It’s 323276388

Tax Tips

Whether you’re preparing to file or wondering why you owe so much money this tax season, we’ve got you covered. Follow these tips to break down complex tax topics and maximize your return. From understanding deductions and credits to spotting red flags in phishing schemes, our articles are designed to help you navigate tax season with confidence.

-

Common (and Costly) Tax Return Mistakes—and How to Avoid Them

These common tax mistakes could delay your tax return or (even worse) trigger an audit. Here’s how to avoid the most common errors. Read More »

-

Debunking Common Tax Myths

It’s tax season! So, before you start gathering your receipts and compiling your expenses, let’s bust some common tax myths once and for all. Read More »

-

How a Last-Minute IRA Contribution Might Lower Your Taxes

Tax Day is just around the corner. So, we’ve got some tips on how you can turn a last-minute IRA contribution into a tax perk. Read More »

-

It’s Time to Talk Taxes

It’s tax season! To get you ready, we’ve got a simple checklist of forms and tax considerations to watch out for before you file. Read More »

-

What is (and is not) a Tax-Deductible Donation

Charitable donations are a great way to give back to your community. Whether you give goods or money, it feels good to support the causes you care about—especially amidst the hustle and bustle of the holiday season. But if you… Read More »

-

Why Do I Owe Taxes This Year? The 10 Most Common Reasons

Did you get a tax bill instead of a tax refund this year? It’s probably because of one of these common factors. Read More »

Tax Time FAQs

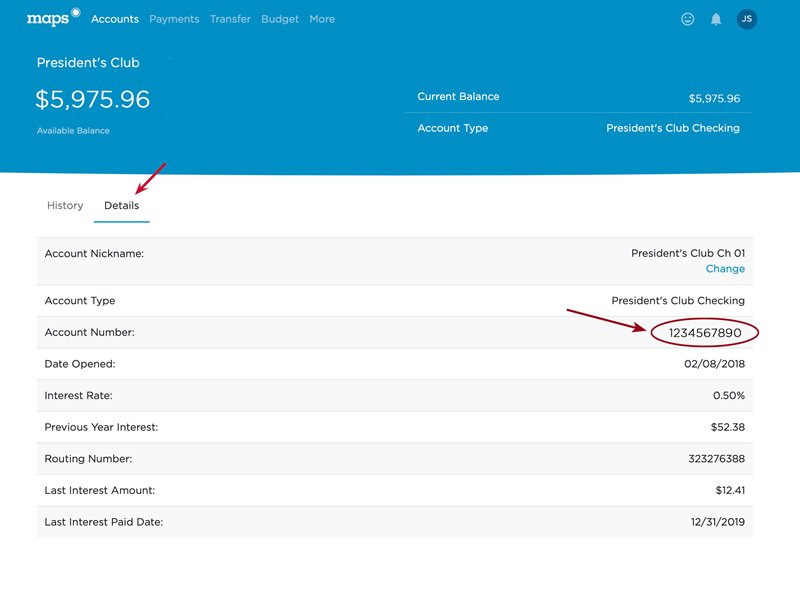

How can I find my account number in online banking?

To find your account number in Online Banking:

- Log in to online banking

- Click on the account

- Click on the “Details” tab

- Your Account Number and Routing Number located on this screen (see example below)

How can I find my account number on my paper statement?

Your account numbers are located in the account summary of your paper statement.

Where is the Maps routing number and my account number on my personal checks?

Your Account Number is located on the bottom of your personal check (not a Cashier’s Check, which will not have your information on it). See the example below.

What is the difference between my “Member Number” and my “Account Number” and why do I need my Account Number for my tax returns?

Your Member Number identifies your membership as a whole, which includes all of your accounts with Maps. Your Account Number identifies which specific account (e.g., checking, savings, money market, etc.) you wish your deposit (in this case, your tax return) to be routed to.

How can I access my tax documents online?

After January 31, you can access your statements for the current tax year by logging into online banking and clicking on the sandwich menu next to “Accounts”. Select “More” and then “Statements” and “View Statements”. This will take you to your eStatements Dashboard where you can view and download your tax documents and monthly statements.

How do I update my mailing address to ensure I receive my tax forms?

There are several ways to update your contact information with Maps. The quickest, easiest way is through digital banking. From the Maps app or desktop site, log in and click on the icon with your initials. Select “Profile” from the drop-down menu and scroll down to the section with options to change your email, phone number, and physical address.

You can also call or text us at 503.588.0181 or stop by your favorite branch to update your information during regular business hours.

Unsure if your information is up to date? Contact us using the options listed above and we’d be happy to check.