Common Banking Fees and How to Avoid Them

Follow these helpful tips to avoid unnecessary banking fees and keep your money safe.

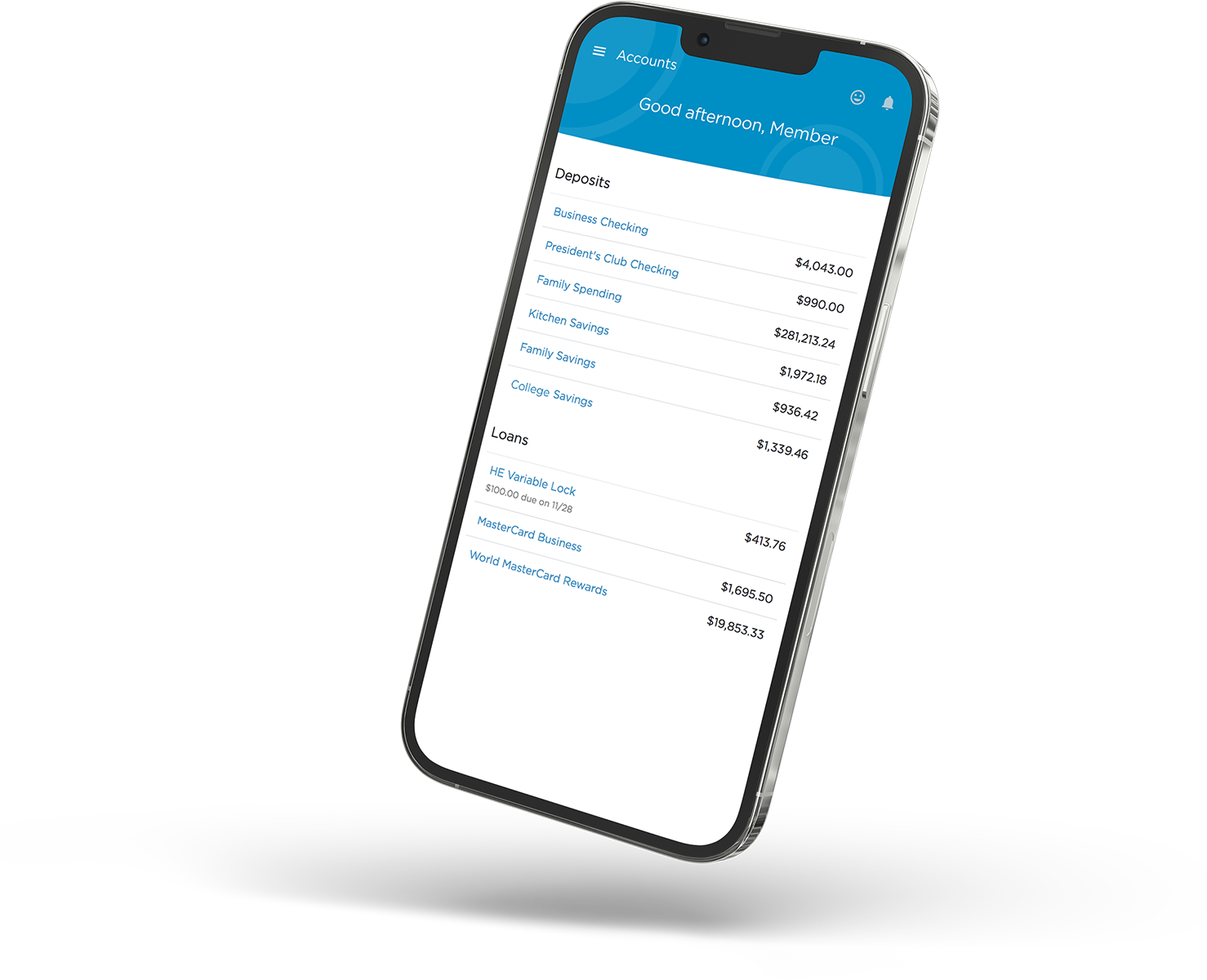

Connect to Online or Mobile Banking

Check your balance, transfer funds, pay bills, access online statements, and keep tabs on your budget using our free digital banking service. Here are some features you’ll find:

- Account history

- Financial management tools

- Bill pay

- Account transfers

- Online statements

- Transaction and balance alerts

Sign up for this free service by registering online.

Set Up Overdraft Protection

To avoid Overdraft and Non-Sufficient Funds (NSF) Fees, connect your checking account to a savings account or line of credit with automatic transfers to cover shortfalls. Examples include:

- Membership Savings Account

- Share Savings Account

- Goldline Personal Line of Credit

- Home Equity Line of Credit

You can open accounts and apply for loans online or find help with both at your favorite branch.

Use In-Network ATMs

ATM fees are typically charged when you use an out-of-network ATM.

- Use ATMs at Maps Branches

- Use a CO-OP branded ATM

Note: In addition to non-Maps ATM withdrawal fees, out-of-network ATM providers may charge fees of their own. This means you could incur two separate charges when using an ATM outside of the Maps network.

Find a free CO-OP ATM or

Credit Union Service Center

Or Text your zip code to 91989

Keep Your Contact Info Up to Date

Update us whenever you change your name, email, home address, or phone number to avoid common fees (like inactive account fees) and stay informed about changes.

Unsure if your information is up to date? Contact us and we’ll be happy to check for you. You can also log into online banking and click on “Profile” to change or check your information.

Frequently Asked Questions

What’s the difference between overdraft fees and Non-Sufficient Funds (NSF) fees?

Overdraft fees are charged when your bank or credit union covers your shortfall temporarily by allowing the transaction to go through. NSF (Non-Sufficient Funds) fees are charged when a bank rejects the transaction.

How can I avoid overdraft fees?

Overdraft fees occur when you spend more money than you have in your account, and your bank or credit union covers the difference.

How to Avoid Overdraft Fees:

- Link accounts. Connect your checking account to a savings account or line of credit with automatic transfers to cover shortfalls. (Note: Member Rewards and money market accounts do not qualify as overdraft protection accounts.)

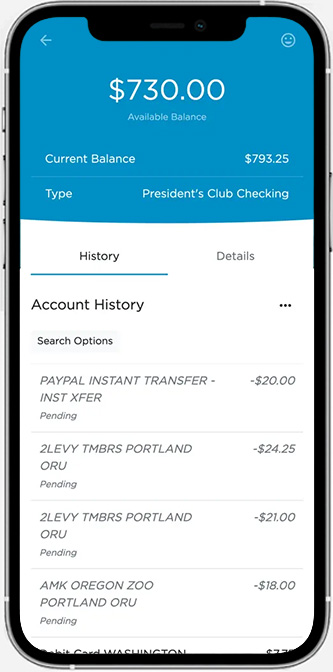

- Monitor your balance. Check your account regularly using your bank’s app or online banking.

- Set up alerts. Enable low-balance notifications in online banking to warn you before your account runs dry.

How can I avoid NSF fees?

NSF fees can be avoided by setting up alerts to notify you when your balance is low and linking a savings account or line of credit to cover the difference if you fall short.

More tips to avoid NSF fees:

- Track your spending. Keep an eye on pending transactions to avoid overdrawing your account. You can check your account activity 24/7 in online or mobile banking.

- Use overdraft protection. Link your checking account to an eligible savings account or credit line.

- Build a buffer. Keep extra money in your account as a safety net.

Can I use any account as an overdraft protection account?

No. Member Rewards and money market accounts (including the Indexed Money Market and Premium Money Market) do not qualify as overdraft protection accounts. You can, however, link a traditional savings account or your line of credit to your checking account for overdraft protection.

How can I avoid ATM fees?

ATM fees are typically charged when you use an out-of-network ATM.

To Avoid ATM Fees:

- Stick to Maps ATMs. Maps ATMS are located at every branch and Maps members have unlimited fee-free transactions at all Maps-operated ATMs.

- Use CO-OP ATMs. There are 30,000 CO-OP ATMs (branded with the CO-OP above) across the U.S. and in multiple countries where Maps members can check balances, withdraw cash, and transfer funds without additional fees. Some co-op ATMs will even allow you to make check or cash deposits.

- Open a Maps President’s Club Checking account. Non-Maps ATM fees are waived for President’s Club Checking account holders (although the ATM provider may still charge a fee).

Note: When using out-of-network (non-Maps) ATMs, the out-of-network ATM provider may charge a fee on top of the Non-Maps ATM Fee. This means you could incur two separate charges when using an ATM outside of the Maps network.

How can I avoid Account Service fees?

Some accounts may incur a service fee, which is charged monthly for maintaining the account when its balance falls below a certain amount.

To Avoid Service Fees:

- Meet the requirements. Take note of the minimum balance requirement (if any) and set up a notification in online banking to alert you when your balance is close to the threshold.

- Choose a fee-free account. If your balance tends to fluctuate, consider an account (like the Free Community Checking) with no minimum balance requirement.

What are Inactive Account fees, and how can I avoid them?

Most banks and credit unions charge a fee if your account remains inactive for an extended period (usually six months to a year). If the account remains dormant for long enough (a period of three years in Oregon), the account may be turned over to the state, which will return it to the rightful owner upon request.

How to Avoid Inactive Account Fees:

- Make regular transactions. To keep your account active, set up a small recurring payment or deposit, like a subscription or transfer to savings.

- Monitor your accounts. Periodically log in or make a minor transaction to show activity.

- Keep your contact information updated. If an account falls dormant, the credit union will contact you to notify you of any pending actions.

- Close unused accounts. If you no longer need an account, close it to avoid potential inactivity fees.

What are Late Payment fees, and how can I avoid them?

Late Payment Fees are charged when you miss the due date for a loan or credit card payment. Those fees are added to the balance of your loan and may increase the interest charged to the account.

How to Avoid Them:

- Know your terms. Review the terms and conditions for your credit card or loan so you know what will happen if you miss a payment or are delayed.

- Set up auto-pay. Schedule automatic payments for recurring bills to ensure they’re on time.

- Use reminders. Add alerts or calendar notifications for upcoming due dates.

- Pay early. If possible, pay bills a few days before the due date to account for processing delays.

Do the same fees apply to business accounts?

No. These suggestions apply to Personal Accounts only. For information about Business banking fees, see our Fee Schedule page.