If you have purchased anything online in the last few years, you’ve likely noticed the “buy now, pay later (BNPL) options offered by services like Klarna, Afterpay, and Affirm on the checkout page. BNPL services let you buy something now and split the payment into several smaller, interest-free installments—often over the course of a few weeks or months. It’s convenient and popular, but is it a good idea? As you shop this holiday season, consider these pros and cons to help you decide if paying later is the right choice for you.

What Is Buy Now, Pay Later?

BNPL services are like a modern version of layaway, but with a twist. Instead of waiting to get your item until after you’ve paid in full, BNPL lets you have the item right away and pay for it over time. The most popular BNPL services (like Afterpay, Klarna, and Affirm) offer payment plans with zero interest if you pay on time. Typically, you’ll make four equal payments spread out over a few weeks or months.

Buy Now, Pay Later Trends

Buy now, pay later services were once primarily offered for beauty and apparel purchases through early-adopting retailers like Sephora, Macy’s, and Amazon. However, the trend has since expanded into other markets—like travel, ticketing, pet care, furniture, and daily essentials—and BNPL use has skyrocketed.

A 2022 Consumer Financial Protection Bureau report found that between 2019 and 2021, the number of loans originated by the top five BNPL lenders grew from 16.8 million to 180 million. It is estimated that those numbers hit all-time highs thanks to inflation and a rise in online shopping during the pandemic.

Why Buy Now, Pay Later is So Popular

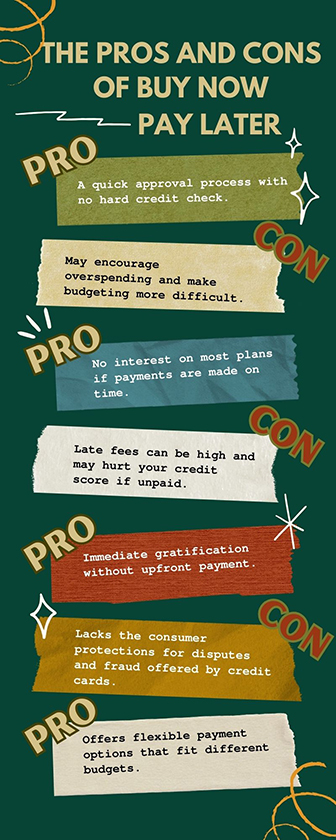

It’s not surprising that BNPL is so popular. The option is tempting because it makes expensive purchases feel more affordable in the short term—especially if you lack access to credit cards or available cash. Here are some other key benefits of BNPL services:

Interest-Free Payments

Many BNPL plans offer zero-interest payments if you stick to a payment schedule. For many, it’s a cheaper option than paying with credit cards, which often carry interest rates over 15% to 20%.

Quick Approval Process

Signing up for BNPL services takes minutes and doesn’t require a hard credit check. These low barriers make it easy for consumers to qualify without a phone call or a trip to the bank. Plus, in most cases, BNPL services won’t affect your credit score the way a new credit card might.

Flexible Payment Plans

Some BNPL services offer flexible payment plans that range from a couple of weeks to several months. This flexibility allows you to break your purchase into chunks that fit into your budget.

Immediate Ownership

Unlike traditional layaway (where you must pay in full before you get your item), BNPL allows you to get the product right away.

The Downsides of Buy Now, Pay Later

While BNPL can be convenient, it’s not perfect. Here are a few reasons why:

Risk of Overspending

Since BNPL spreads the payments out, it’s easy to trick yourself into spending more than you’d normally spend. People who use BNPL regularly are more likely to spend beyond their means, leading to potential financial stress later.

Complicated Budgeting

Having multiple BNPL payments can make it difficult to keep track of your budget. This is a real problem because, as the trends show, cash-strapped consumers (or what the Federal Reserve dubbed “financially fragile” consumers) are more likely than financially stable consumers to use BNPL services repeatedly. In fact, according to the Fed, roughly six in 10 financially fragile BNPL users relied on BNPL services five or more times in 2023. By contrast, only a fifth of financially stable BNPL users used BNPL services five or more times last year. When juggling more than one BNPL purchase, it’s easy to forget when your payments are due. This can lead to missed payments, late fees, and, potentially, damaged credit.

Late Fees Can Add Up

Although BNPL plans don’t usually charge interest, they do charge late fees if you miss a payment. These fees can add up quickly, especially if you have multiple BNPL accounts. Plus, missing a payment can hurt your credit score if the BNPL provider reports it.

Limited Consumer Protections

Credit cards come with consumer protections that help with disputes or fraud, but not all BNPL services offer the same level of protection. In 2024, the Consumer Financial Protection Bureau (CFPB) announced changes that increased consumer protections for BNPL services. It was a significant regulatory shift, but the new interpretive rule doesn’t always hit the mark in the largely unregulated BNPL market. So, if something goes wrong with your purchase, resolving it can still be complicated.

“The CFPB’s new rule will help ensure consumers who use BNPL credit can dispute charges and get their money back promptly just as they are guaranteed by law when they use a credit card,” said Jennifer Chien, senior policy counsel at the nonprofit, Consumer Reports. “Unfortunately, BNPL credit still lacks a number of critical consumer protections that put borrowers at risk.

Is BNPL Right for You?

BNPL can be a good option for certain purchases, but it’s not always the best choice. Here are some questions to ask yourself:

1. What am I using a BNPL loan for?

Using BNPL to cover essential items or emergencies can be risky. If you’re relying on BNPL for groceries, gas, or other essentials, this may be a sign to re-evaluate your budget.

2. Am I using BNPL because I can’t afford the purchase?

Overextension is a common problem with buy-now, pay-later services since the delayed payments make it easy for us to spend more than we otherwise would. Before you make a purchase, consider all of your upcoming living expenses (including rent/mortgage, loan payments, utilities, etc.) and make a plan for paying off the debt. If you are uncertain how you’ll be able to pay off the loan (or if you already have a BNPL loan), consider waiting until there’s more room in your budget.

3. What are my financial goals?

If you’re focused on saving, building an emergency fund, or paying off debt, a BNPL purchase can interfere with those goals by making it easier to overspend. Consider whether the purchase aligns with your long-term financial priorities.

4. Do I understand the terms?

Before you make a purchase and agree to payments, know what you’re getting yourself into. Read the terms and conditions to decipher the late fees and interest charges (if any). Learn what happens if you stop paying or need to return the item.

5. Is there a better way to pay for this item?

First, ask yourself whether the purchase you’re making is big enough to justify a payment plan. If you can afford to purchase the item outright, it might be wiser to bite the bullet and pay upfront. If you need a payment plan and have room on a credit card, ask yourself whether you’ll be able to pay off your purchase before the next statement date. If you can, you may be better off purchasing the item with your credit card.

Tips for Using BNPL Responsibly

If you decide to use buy-now, pay-later services, here are a few tips to keep your spending on track:

- Set Reminders. Use phone reminders to keep track of payment dates, so you’re less likely to miss one.

- Limit Your BNPL Purchases. Stick to one or two BNPL purchases at a time, so you can manage payments more easily.

- Only Buy What You’d Buy with Cash. Before using BNPL, ask yourself if you’d still make the purchase if you had to pay in full. If not, it might be a good idea to skip it.

- Have a Backup Plan. If you lose your income or face an emergency, you’ll still be responsible for making your BNPL payments. Make sure you can manage these payments, even if circumstances change.

The bottom line is that buy-now, pay-later services can be helpful, but only when used responsibly. They offer convenience and flexibility but can lead to overspending and extra fees if you’re not careful. The key is to treat BNPL as a tool, not a crutch. With smart planning, it can work for you—especially if you want to spread out the cost of holiday purchases and traditional credit is not an option. Remember your budget and financial goals, and keep your upcoming expenses in mind before you click “Buy Now.”

Want more tips on holiday shopping?

- Check out our tips for setting a realistic holiday budget.

- Learn how to stay safe while shopping online this holiday season.