Today, October 17, 2024, is International Credit Union Day. Every year on the third Thursday in October, credit unions across the world take a moment to celebrate the history, spirit, and accomplishments of the credit union movement.

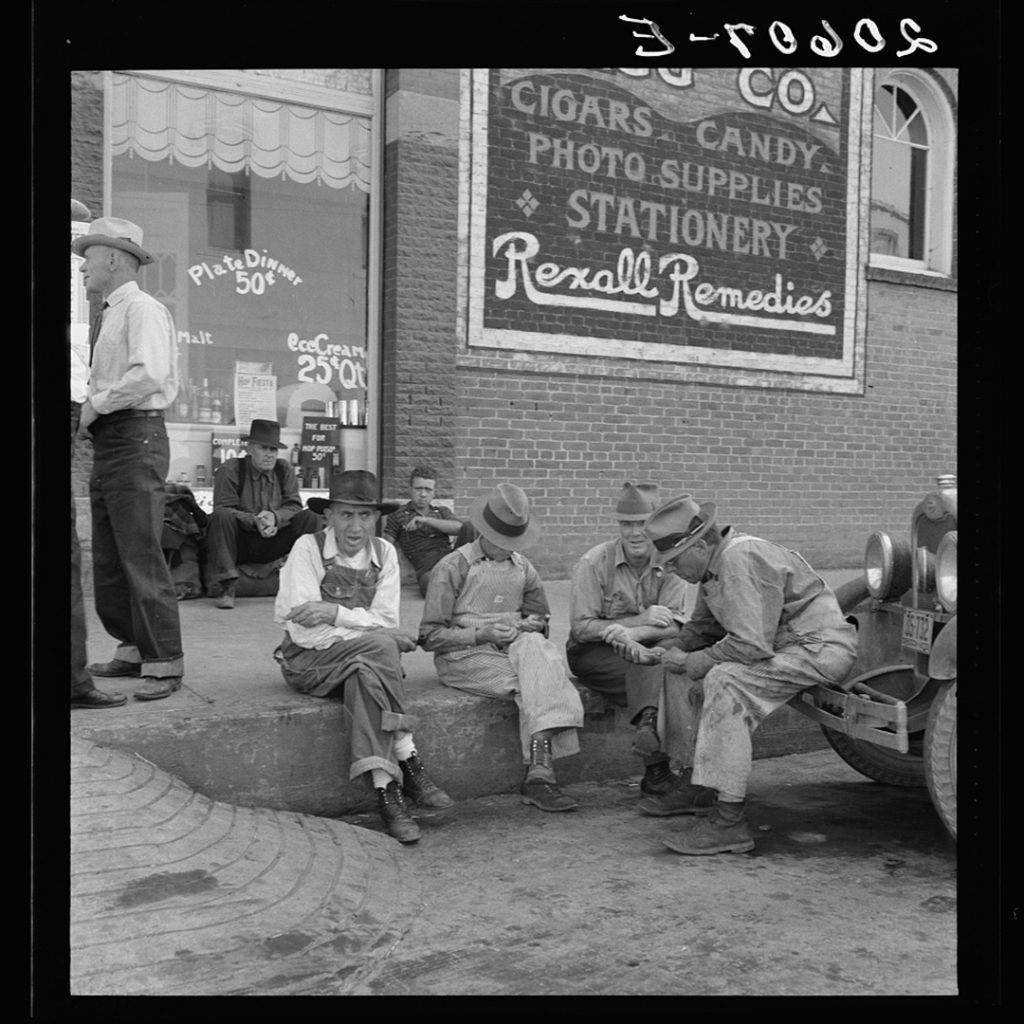

Why? The credit union movement took hold when millions of Americans faced severe economic hardships—including high unemployment, widespread poverty, and a general mistrust of traditional banks. The trailblazing credit unions of the early 20th century were founded upon a philosophy of service and a “people before profit” mindset—something traditional banks couldn’t (or wouldn’t) do. Those principles are still the backbone of what credit unions across the nation (including Maps) do. We are rooted in community spirit and the idea of people helping one another.

What is a Credit Union?

A credit union is a not-for-profit financial cooperative where members pool their money to provide loans and other financial services to one another. Unlike traditional banks, credit unions are owned and controlled by their members. The idea is to offer fair and affordable financial services to those who need them. Instead of benefiting shareholders, credit union profits are returned to the members in the form of lower fees, better interest rates, and improved services.

Financial empowerment is one of the founding principles behind credit unions. Early advocates of the movement believed that people could fare better by pooling their resources to loan money to their neighbors and coworkers. But, of course, the growth of the movement was fueled by necessity. In the early 1930s, at the height of the Depression, debt was rampant. An astounding 24.9% of the nation’s total workforce (some 12,830,000 people), were unemployed. Wage income for those lucky enough to stay employed fell 42.5% between 1929 and 1933. Unfortunately, many who were struggling to make ends meet couldn’t get a loan from a traditional bank. Instead, they were forced to turn to sketchy loan operations that charged exorbitantly high interest rates.

The Early Days of Credit Unions (1800s)

The roots of the credit union movement trace back to Europe in the mid-19th century. It was a time when many people, especially farmers and workers, found it difficult to access fair financial services.

- Germany: In 1849, Friedrich Wilhelm Raiffeisen, a mayor in rural Germany, pioneered the first cooperative lending societies to help farmers access credit at fair rates. These societies allowed local farmers to pool their savings and make loans to one another at low interest rates. This concept was revolutionary because it provided an accessible alternative to the high interest rates charged by moneylenders.

- France: At the same time, in 1864, a Frenchman named Hermann Schulze-Delitzsch started the first urban credit unions, which followed a similar model to Raiffeisen’s but catered to city workers and tradespeople.

Both Raiffeisen and Schulze-Delitzsch shared the vision of self-reliance and cooperation, which became the foundation of the credit union model we know today.

The Spread to North America

The credit union concept didn’t take root in North America until the early 20th century. The first credit union in the U.S. was founded in 1908 in Manchester, New Hampshire, thanks to a Canadian named Alphonse Desjardins.

- Canada: Desjardins had already founded the first North American credit union in Lévis, Quebec, in 1900. He was motivated by the desire to combat usury and provide fair financial services to working-class citizens. His success in Canada inspired the establishment of credit unions in the United States.

- United States: After meeting with U.S. reformers, Desjardins helped found the St. Mary’s Cooperative Credit Association in 1908, the first American credit union. This laid the groundwork for the credit union movement across the country.

By the 1930s, the Great Depression had led to widespread distrust of traditional banks, and many Americans turned to credit unions for their financial needs. In 1934, President Franklin D. Roosevelt signed the Federal Credit Union Act, which allowed the creation of federally chartered credit unions across the country. This law helped solidify the presence of credit unions as an alternative to for-profit banks.

Credit Unions in Oregon: A Rough Beginning

Credit unions have a strong history in Oregon, but they got off to a really rocky start.

The first “credit union” in Oregon, chartered in Portland in July 1915, turned out to be a scam. It was shut down just 30 days after it was organized. The next two credit unions were legitimate, but also short-lived. One (also in Portland) lasted a year but failed to transact any business because the federal Farm Loan Bill was still stuck in Congress. The third Oregon credit union, known as the Douglas County Rural Credit Union, was organized in Roseburg in August of 1923 but dissolved sometime in 1924.

So, it wasn’t until the late 1920s that the credit union movement truly gained momentum in Oregon. The Portland Postal Employees Credit Union (Oregon’s first successful credit union) was established in June of 1928. One year later, it had amassed a share capital of over $10,000 and over 239 members.

The first credit union in Salem was the Salem Postal Credit Union, which was chartered in 1930 to serve postal employees in Marion, Polk, and Yamhill Counties. SPCU (which is now Valley Credit Union) became the fourth operating credit union in the state. It was among a surge of U.S. credit unions focusing membership on public employee groups (like teachers and postal workers) and major industries (like power companies and railroads).

For the next decade, the Oregon credit union movement slowed to a crawl—largely due to the Great Depression. Nonetheless, Oregon cooperatives would continue to grow and thrive—particularly following the passage of the Federal Credit Union Act.

Maps Credit Union

On June 6, 1935, a handful of teachers from Marion County Public Schools and Willamette University signed a certificate to start a credit union. They named it Salem Public School Teachers Credit Union. Our first annual meeting was held on December 4, 1935, and the initial share cost was $5.

The first treasurer for the fledgling credit union was Harry Johnson, then principal of Salem Senior High School. Johnson and his secretary managed the credit union operations out of the school office. In 1955, Johnson retired as principal and moved the credit union operations to his home kitchen, which was located on South 12th Street in Salem, Oregon.

Why Credit Unions Matter Today

To this day, credit unions remain vital part of the modern financial landscape. In part, because they prioritize the well-being of their members over profits. In fact, as of March 2024, there were over 140 million credit union members across the United States.

Here are a few reasons why credit union growth is still strong:

- Member Ownership. Members, not shareholders own and control credit unions.

- Better Rates. Since they’re not focused on profit, credit unions often offer lower interest rates on loans and higher returns on savings.

- Community-Focused: Credit unions tend to be more involved in local communities, giving back through education, charity, and services tailored to local needs.

So, Happy International Credit Union Day! We’ve changed a lot over the years, and we are so proud to be a part of the Willamette Valley credit union movement. After all, it’s not about being #1, it’s about empowering our members. Every step forward is a step we make together. We focus every goal on the founding principle of helping members find financial empowerment and then give that empowerment back to the community. As we continue to grow and adapt, our mission will always be “every member matters”. We take that very seriously.