If you understand what the Federal Deposit Insurance Corporation (FDIC) does for banks, then you already have an idea of what the National Credit Union Administration (NCUA) does for credit unions. If you don’t, the NCUA is an independent government agency that regulates and insures credit unions. Put simply, when you deposit your money at a federally insured credit union, that money is safe and insured up to a designated limit. Since we’re digging into the fundamentals of banking this month, let’s explore the NCUA, how it works, and why it’s important.

What Is the NCUA?

The NCUA was established in 1970 to regulate and supervise federal credit unions in the United States. Much like the FDIC insures deposits at banks, the NCUA insures deposits at credit unions through the National Credit Union Share Insurance Fund (NCUSIF). So, if a federally insured credit union fails, your money is protected up to $250,000 per person, per account ownership category.

The History of the NCUA

When the Federal Credit Union Act passed in 1934, the Bureau of Federal Credit Unions (part of the Farm Credit Administration) initially managed all credit unions. However, regulatory responsibility shifted several times over the decades between the 1930s and the 19070s. For a brief moment (in 1942), credit union supervision was even transferred to the FDIC.

By the late 1950s and early 1960s, the credit union industry was flourishing but operating without federal deposit insurance. This was worrisome because, by the end of 1960, there were 9,905 federal credit unions with 6.1 million members and $2.7 billion in assets. So, in the late 1960s, Congress began to discuss an independent federal regulator for credit unions.

Congress established the NCUA by an act of March 10, 1970, and reorganized it by an act of November 10, 1978. The independent agency (an executive branch of the Federal Government) would charter and supervise credit unions. It initially insured share deposits up to $20,000, but that number increased to $100,000 in 1979 and $250,000 in July of 1979. Those limits were on par with the deposit insurance limits offered by the FDIC.

How Does the NCUA Work?

The NCUA has three main jobs. They regulate credit unions, insure member deposits, and charter new credit unions.

- Regulation: The NCUA sets rules and guidelines that federal credit unions must follow. These rules are designed to keep credit unions financially healthy. They are also designed to protect the interests of credit union members. Credit unions submit to regular examination by the NCUA to ensure they are following these regulations and managing risks properly.

- Insurance: The NCUA provides insurance through the NCUSIF, which protects the members’ money if a credit union fails. This insurance covers up to $250,000 per person for accounts like savings, checking, and money market accounts. For joint accounts, each account owner is insured up to $250,000.

- New Charters: The NCUA also charters (a.k.a., approves) the creation of new federal credit unions. So, if a group of people wants to start a new credit union, they can’t just throw open the doors. They must first meet the minimum operation requirements and get permission from the NCUA.

Why the NCUA is Important

Why all this regulation? The NCUA is, of course, about protecting your deposits (and we love that they do). But, more importantly, the NCUA plays a vital role in keeping the entire credit union industry strong and trustworthy. Here’s why it matters:

- Ensuring Fair Practices: By examining and regulating credit unions, the NCUA helps prevent credit unions from taking too many risks that could lead to financial trouble.

- Conducting Investigations: The NCUA regularly inspects credit unions to ensure they are following regulations and managing their finances properly.

- Providing Guidance: The NCUA offers resources and guidance to credit unions to help them improve their services and operations.

- Promoting Financial Stability: In times of financial crisis, the NCUA can step in to help credit unions that are struggling. This helps prevent widespread issues in the credit union system.

NCUA Quick Facts

- The NCUSIF is funded by credit unions and not the taxpayers.

- The FDIC and NCUA are both federal agencies that insure deposits. However, the NCUA is exclusively for credit unions while the FDIC is for banks.

- The NCUA does not insure mutual funds, stocks, bonds, municipal securities, life insurance policies, or safety deposit boxes.

- The NCUA does insure checking, savings, money market, term accounts (like certificates of deposit) and certain trusts.

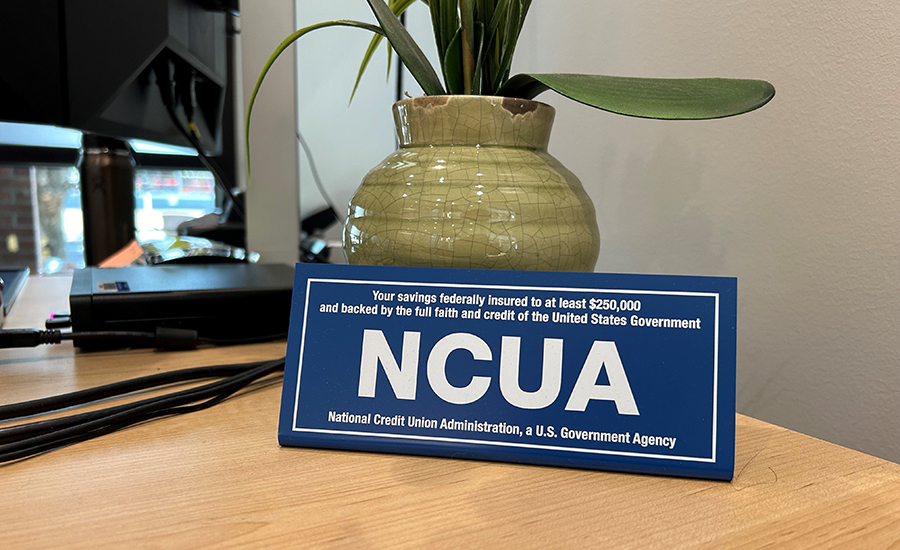

- NCUA-insured credit unions must display an NCUSIF sign that reads, “Your savings federally insured to at least $250,000 and backed by the full faith and credit of the United States Government” (see image above).

- The NCUA is headquartered in Alexandria, Virginia. It has eastern, southern, and western regional offices that carry out the agency’s supervision and examination program.

- The NCUA is governed by a three-member Board of Directors. Each member is appointed by the president and confirmed by the Senate.

- As of March 31, 2024, there were 4,572 federally insured credit unions with 140.4 million members and $2.31 trillion in assets nationwide.

Want to learn more about the history and fundamentals of banking?

- Check out our article on how to kickstart your savings for National Savings Day.

- Learn how Maps Credit Union got its start—almost 90 years ago.

- Discover the stories behind popular money superstitions like lucky pennies and itchy palms.