There’s a popular saying that goes, “If you can read this, thank a teacher.” At Maps Credit Union, we definitely have teachers to thank for our success. It’s been nearly 90 years since a group of school employees gathered to form what would eventually become Maps Credit Union. Their original mission was to create a safe place for Salem school employees and their families to house their money and get low-cost loans. However, their principles of financial empowerment and community building are still at the core of what we do.

As an organization, we aim to be a partner for positive change—not just for our members but in all areas of life. Whether operating from a home kitchen, a state-of-the-art branch, or the digital landscape, the goal has always been to treat all members with respect and dignity. The mission has always been to offer honest, fair opportunities for financial growth. To this day, our guiding principles are built around our proud history and our 1935 start.

As you’ll see, we’ve grown a lot—and changed our name a few times—in the name of providing a safe and secure environment for our members’ hard-earned money.

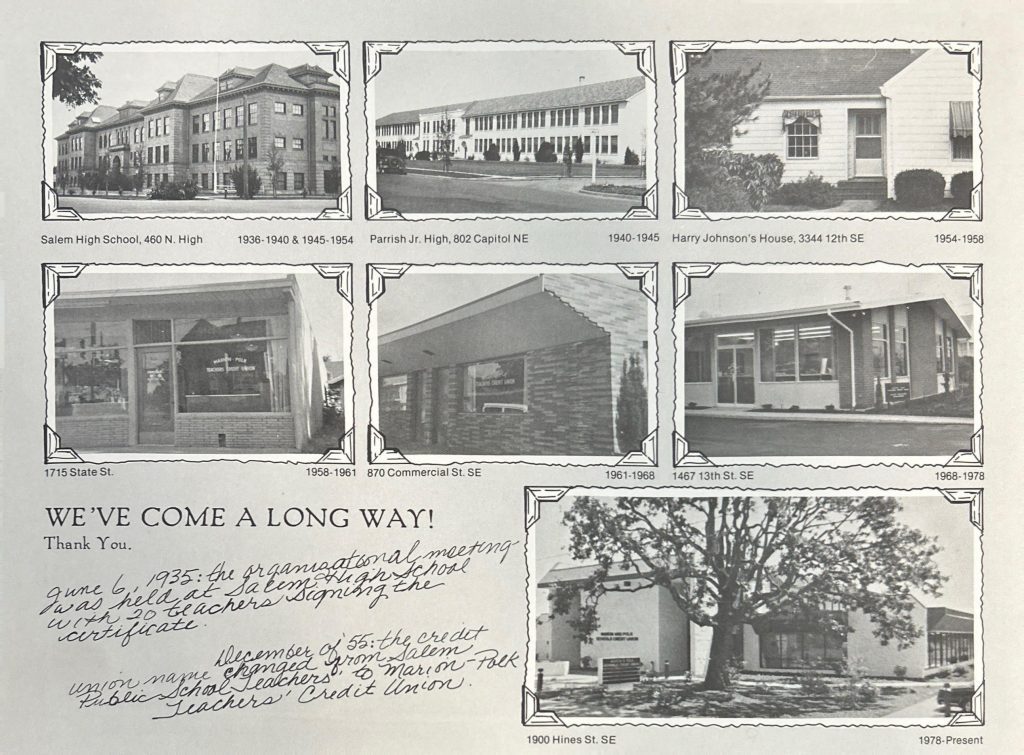

1935 to 1945 (Our Origin Story)

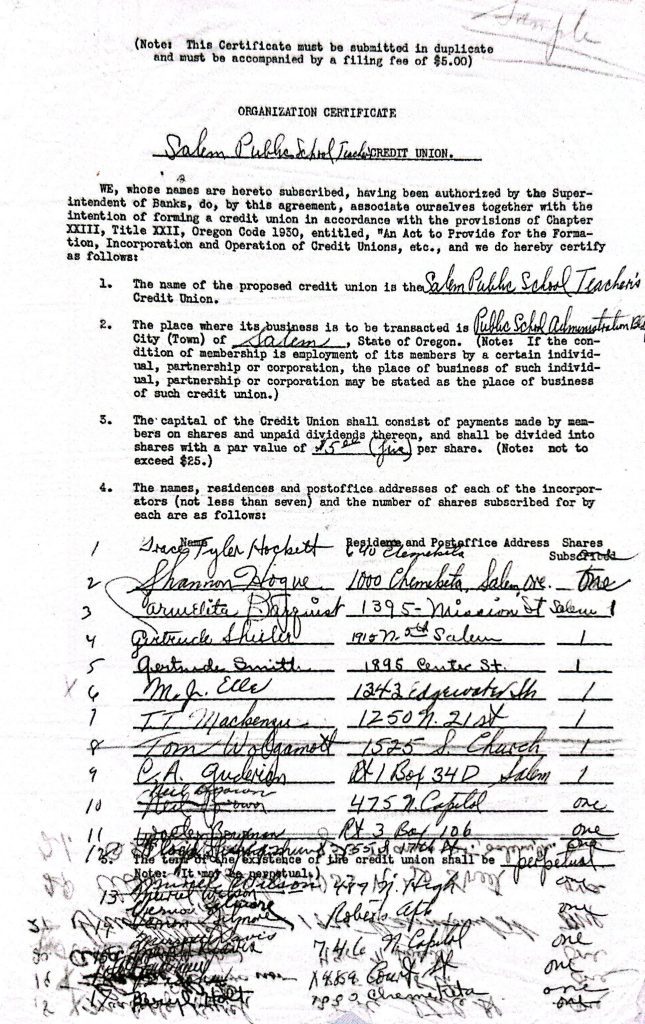

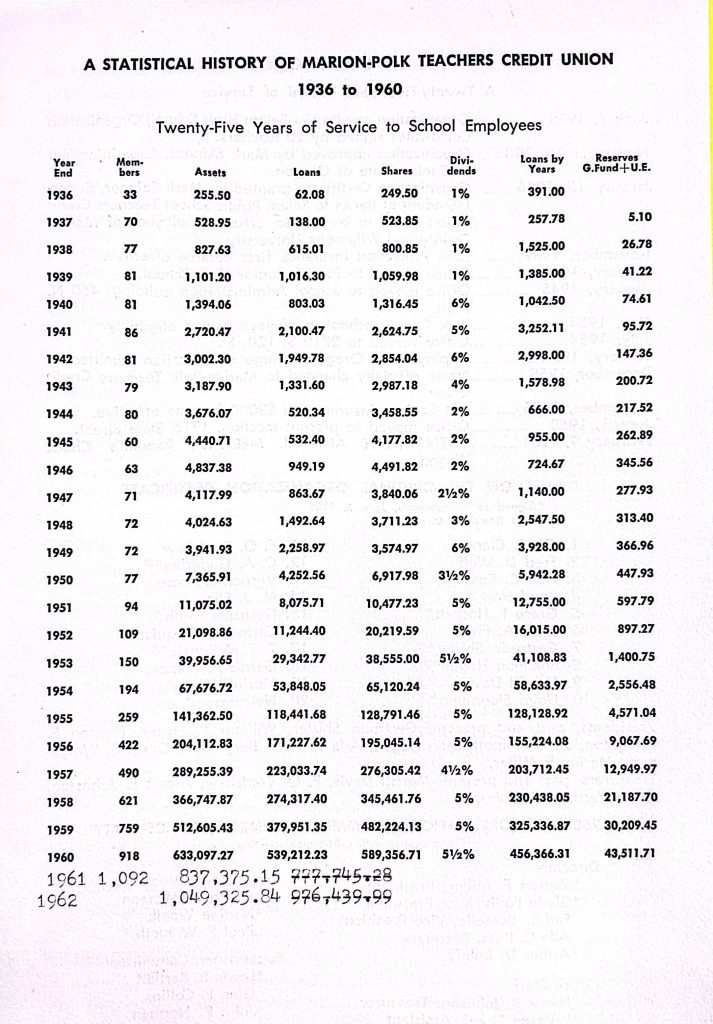

The late 1930s and early 1940s were largely defined by the end of the Great Depression and the beginning of the Second World War. In 1934, President Franklin D. Roosevelt passed the Federal Credit Union Act. Just one year later, a group of teachers met at what was then called Salem Senior High School and decided to start a credit union. They called it Salem Public School Teachers Credit Union. At the time, there were only a few credit unions in Oregon (six established between 1928 and 1934) and only one in Salem. Salem Postal Credit Union, which was established in 1930, was the first to open in Marion County.

In the early 1930s, Oregon had a smattering of credit unions, but not many. Then, in 1934, President Franklin D. Roosevelt passed the Federal Credit Union Act. This new law allowed people with common bonds (like teachers, postal workers, and railroad employees) to pool their scarce resources for the greater good. It marked a step toward the financial independence necessary to build a new and better quality of life amid the hardships of the Great Depression.

On June 6, 1935, just one year after the Federal Credit Union Act became law, an organizational meeting was held in what was then called Salem Senior High School. That day, 20 teachers agreed to volunteer their time and talents to start a credit union that would benefit all Willamette University and Marion County Public School employees including “administrative, office, and janitorial employees as well as teachers.”

They called it Salem Public School Teachers Credit Union. The organization was approved on November 18, 1935, and the first annual meeting was held on December 4, 1935, in room 2G of the high school. Each of the 17 original members paid the initial share cost of $5 (which, incidentally, is still the cost of a share today). That $85 seed money was deposited at Ladd & Bush, Bankers & Trust Company—and the credit union was in business. The records and day-to-day credit union funds were kept in a desk drawer.

In June of 1940, the state examiner insisted that the credit union find a fireproof safe to store its records, so permission was granted to move credit union documents to the office safe at Parrish Junior High.

By late 1941, WWII was in full swing across the pond, and—especially in the wake of the attack on Pearl Harbor—American attention shifted in support of Allied war efforts. A wartime economy ensued, and everyone began to tighten their belts. With an uncertain economy and rations on food, gas, and clothing, people were less interested in borrowing money. Credit union membership dropped, and closure was discussed, but ultimately, the credit union persevered.

1945 to 1955 (Our Kitchen Era)

As the world recovered from World War II, tension between the United States and the Soviet Union led to a geopolitical struggle known as The Cold War (which also led to the beginning of the Space Race and the launch of Sputnik 1 in 1957). Harry Truman was President of the United States until America decided it “liked Ike” and elected Eisenhower in 1953. Meanwhile, our very own Harry, Harry Johnson (a.k.a., the credit union’s first treasurer), was also the principal of Salem Senior High School. So, he and his secretary managed credit union operations from the school office.

In 1947, the newly elected treasurer of our fledgling credit union was Harry Johnson, who also happened to be the principal of Salem Senior High School. On March 6, 1947, they decided to move credit union records to his office at the Salem Senior High Administration Building, which stood at 460 N. High Street (where Macy’s now stands). The move satisfied the State Banking Department’s recommendation for an independent and secure credit union address. Johnson and his secretary, Ardith Combs, managed credit union operations out of the school admin office under the direction of the Board of Directors, the Credit Committee, and Oregon bank administrators.

In 1954, Polk County school employees were approved for eligibility. By 1955, under the leadership of Johnson and Credit Union President Grace S. Wolgamott, the Credit Union’s membership had grown to 259, and assets reached $141,363.

When Harry Johnson retired in 1955, he moved the credit union operations to his home kitchen, which was located at 3344 12th St SE in Salem, Oregon. Johnson’s wife, Alice, took over the duties of office assistant.

1956 to 1965 (Our Office Era)

In the 1950s and 1960s, the Cold War loomed and a conflict in Vietnam, Laos, and Cambodia spilled over into a war that would stretch across two decades. President Kennedy was assassinated, as was Malcom X. Motown brought us hits like “Please Mr. Postman” and “Come See About Me”. The Sound of Music topped the box office, and the bikini gained popularity on American beaches. For our part, we reached the $1 million asset mark—and outgrew Harry’s kitchen.

With Marion Miller, the new board president, at the helm, the credit union board approved the name Marion-Polk Teachers Credit Union on January 18, 1956. That same year, Oregon College of Education (now Western Oregon University) employees and students became eligible for membership. At the time, the major selling point for credit union membership was a no-fee CUNA Mutual life insurance policy on share investments up to $1,000—not to mention a competitive fixed monthly loan payment of just 1% on balances due.

In 1958, the credit union moved from Harry Johnson’s kitchen to 1715 State Street, where (for a $ 75-per-month rental fee) it enjoyed all the necessary bells and whistles of an official business location, including office equipment, janitorial service, a part-time assistant, and its first electronic adding machine. In 1959, LaVerne Bickel left her job at the DMV to become the credit union’s second full-time employee (after Harry Johnson).

But by 1961, Johnson and Bickel required even more space, so the credit union signed a five-year lease for space at 870 Commercial Street SE (near the current location of The Konditorei). By October 1962, the credit union reached a $1 million asset mark.

Harry Johnson retired on June 30, 1964, and was given a gold watch in gratitude for his years of service. He continued to help out part-time for $2.50 an hour until a third part-time employee was hired.

1966 to 1975 (The SWIFT Era)

The late 1960s and early 1970s were marked by the Vietnam War and anti-war protests. Richard Nixon was elected as President, promising a “peace with honor” end to the war. The civil rights movement continued to bloom across the country and activist Martin Luther King Jr. was assassinated. The Fair Housing Act of 1968 banned discrimination in the sale or rental of housing. Beatlemania was booming and the Summer of Love was alive with the sounds of the Mamas & the Papas, Jefferson Airplane, and Janis Joplin. Americans walked on the moon. In 1972, the Watergate Scandal rocked Washington, D. C. just as the fourth installment of the Planet of the Apes film series hit the box office. This era also brought office space, automation, and additional employees to the credit union—and we jumped from $2 million in 1967 to $9 million in 1975.

In the 1970s, the credit union membership bylaws were revised to include employees of any school in Marion or Polk County, and membership grew.

The late ’60s and early ’70s also brought additional employees and space to Laverne Bickel, our hardworking, near-solo employee. In 1967, the board purchased a lot at 1467 13th Street for $7,950 (and the lot behind it for $4,491). They broke ground for a new building in 1968, and the 2,400-square-foot space opened in October of the same year. The credit union also gained a slide projector, photocopier, printing press, postal meter, shredder, and dictation/transcription equipment. Electronic processing was also introduced in 1968.

Technology moves fast, so the 1970s also brought computers to the credit union. By 1974, the credit union would shift to online data processing with in-house computers—the first terminal arrived in 1974 and the second in 1975.

This is also the era when Automated Clearing House (ACH) systems and Electronic Funds Transfers (EFT) emerged. Most banks and credit unions communicated through a network called the Society for Worldwide Interbank Financial Telecommunication (SWIFT), a global messaging network for efficiently transmitting money transfer instructions. Prior to SWIFT, they relied on passbooks, hand-posting, telegraph wires, and the TELEX system to process global transfers (which is why we still use the phrase “wire transfer”). The system moved at a snail’s pace and was not reliably secure.

However, growth was evident at Maps in all areas. In 1967, the credit union hit the $2 million asset mark, but by 1975 (at the end of the Vietnam War), it reached $9 million.

1976 to 1980 (Our Rebranding Era)

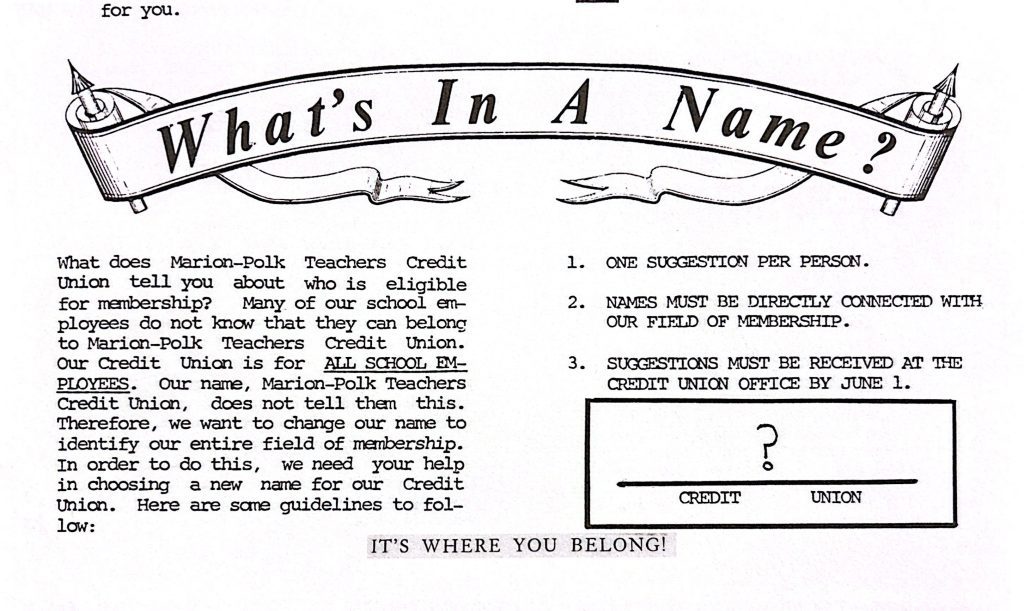

The latter part of the ’70s brought us Wheel of Fortune, Saturday Night Live, and Star Wars. America elected Jimmy Carter as President and said goodbye to Elvis Presley, the king of rock and roll. And, as the credit union celebrated its 40th anniversary, a new name (and a new building) became necessary. So, the credit union put a call out to members for ideas on a name (see image below). The chosen name was Marion & Polk Schools Credit Union.

The economy slowed in the mid-1970s, but interest in the credit union was still high. By July of 1976—the year of the credit union’s 40th anniversary—membership reached 6,166. To accommodate (and more precisely describe) the growing field of membership, the board held a “Name Your Credit Union” contest. The chosen name was Marion & Polk Schools Credit Union.

With rapidly expanding membership, Marion & Polk Schools Credit Union needed a new branch. In fact, 1,000 members joined in 1977 alone. So, the Board of Directors purchased 2.9 acres at 1900 Hines Street SE for $162,500. In December 1977, they broke ground on a new 26,000-square-foot building.

The Hines Street branch opened in November 1978 and remains a vital part of our branch structure today.

In the late ’70s and early ’80s, the credit union broadened the field of membership to include employers of enrolled members (1977), retirees and spouses of deceased members (1978), non-household family of members, and school volunteers (1983). Consequently, membership doubled between 1976 and 1985 to 11,687.

1980 to 1989 (Our Resiliency Era)

The “decade of excess” was a volatile time in banking. Fuel prices and interest rates were high and inflation peaked at 14.6%. The Reagan Administration declared a “War on Drugs” and Mount St. Helens erupted. The world watched as the Challenger Space Shuttle was launched (and tragically destroyed) on its maiden flight. Nonetheless, it was a time of strong economic optimism and growth. The Berlin Wall fell, and the end of the Cold War was in sight. Personal home computers could be purchased at Radio Shack and MTV aired its first music videos. The credit union welcomed new President and CEO Dan Penn—and its 12,000th member.

The 1980s were a dynamic time for America and Marion & Polk Schools Credit Union, which had quickly been nicknamed “MaPS” by members and the community. The “decade of excess” started with an upsetting 1980 audit that revealed $65,000 in mishandled operational funds. The issue was quickly resolved (and all the funds were recovered) before the end of the year, but it was clear that (with so many moving parts and new members) the credit union needed some guidance.

So, in June 1980, Dan Penn was hired (as treasurer-secretary-manager) to restructure internal operations. At the time, the stock market was volatile, fueled by skyrocketing interest rates, a brief recession, the deregulation of the Savings and Loan industry, and the closure of several small banks and credit unions. Fortunately, as the former CEO of Federal Metals Credit Union in Albany (which is now Central Willamette Credit Union), Penn offered vital insights and an ongoing analysis of the tenuous financial environment. Near the end of the decade, his role would remain, but his title would shift to “President and CEO.”

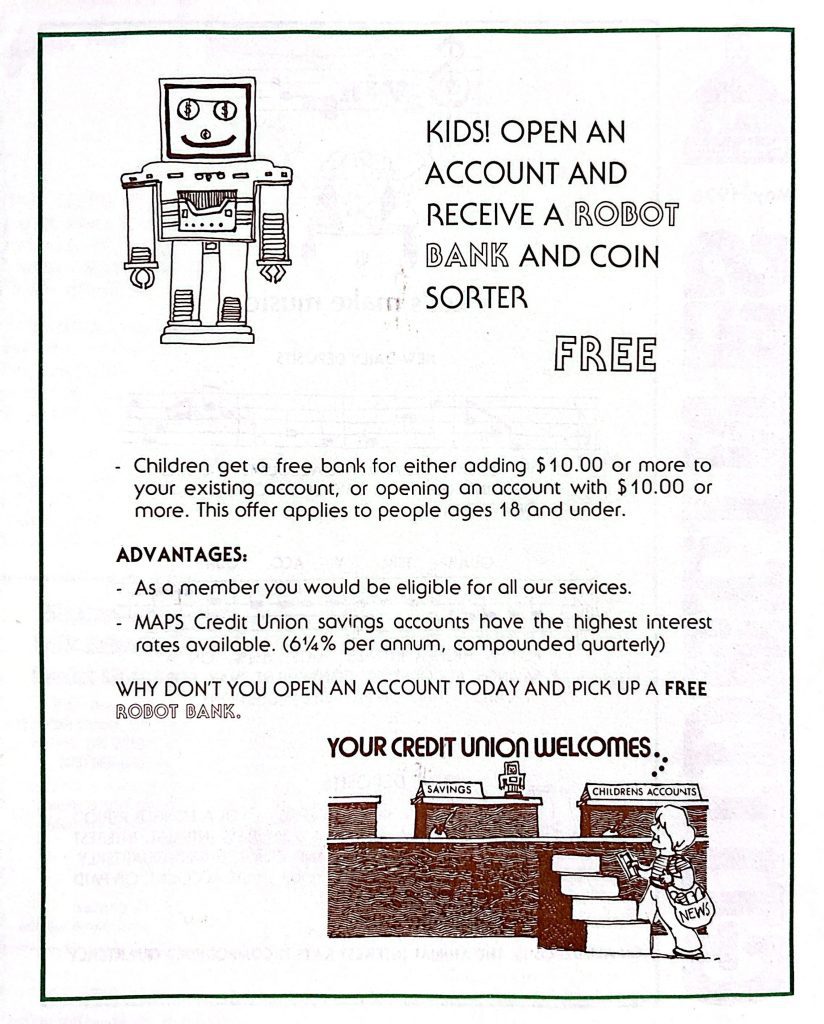

By 1983, money was on the minds of most Americans, including children (who had previously been ignored by most banks). To address the growing youth market, Maps launched the Moola Moola Savings Club for children under 13. By the close of 1984, the club had over 600 youth members.

In the early 1980s, Maps was also the first in Oregon to start offering members access to their accounts through a phone banking system called PrivateLine. Members could set up a PrivateLine password and call a special number to perform basic transactions or check their balance.

The mid-1980s also saw the credit union launch The Credit Union Service Organization (CUSO), a taxable subsidiary that offered services not provided under the credit union structure, such as insurance products (1984), financial counseling (1985), and auto-buying contracts through outside vendors (1985).

Meanwhile, by 1985, the number of employees grew, and membership doubled to 11,700. Our 12,000th member joined in July of 1986. In 1986 (our 50th anniversary), the credit union’s first ATM was installed in Building 2 of Chemeketa Community College (CCC), initiating a long-term collaboration with the college. By the end of the decade, Maps would move from a local computer network to an area-wide network in preparation for a wave of new branches.

1990 to 1999 (Our Branch Era and a Fond Goodbye)

In the 1990s, Generation X embarked upon adulthood, and the internet changed the way we communicate. America was glued to the television watching the O.J. Simpson Murder Trial, Tonya Harding, Seinfeld, and Friends. Radios blasted grunge rock, The Spice Girls, and Tupak Shakur. At Maps, we opened six branches, and we said goodbye to Laverne Bickel, who retired after 32 years with the credit union

On March 1, 1991, the credit union’s first full-time employee, Laverne Bickel retired after 32 years. Bickel, who was hired by Harry Johnson, worked primarily at the Hines Street branch. It is rumored that she knew all 15,000 credit union members by name. To this day, we get comments from members who remember Bickel and her ability to recall not only their names but also details about their lives.

In the 1990s, we opened six branches—including two at local high schools. Our first branch in West Salem (at 1137 Edgewater Street NW) opened in May of 1992, the same year we launched the Maps phone center (which is now known as The Contact Center). One year later, we opened the Chemeketa branch at 4001 Winema Place. It is now one of our busiest branches.

In the mid-1990s, under the guidance of new VP of Marketing Cathy Grimes, Maps partnered with North Salem High School to open the North Salem High School Branch, the first in the ongoing Maps High School Branch Program. At that branch, which was staffed by student tellers, students would learn about the financial industry and gain valuable job skills. Alongside school advisors and Maps professionals, student tellers also taught their peers the importance of budgeting and saving. Over the years, our Student Branches have become invaluable for students interested in leadership roles or careers in finance.

In 1994, we also started CU Wireless, a cellular services company, and Advanced Reporting, which provides credit reporting services to lenders and financial institutions. These businesses operate as separate entities known as Credit Union Service Organizations (CUSOs). The CUSOs are owned by Maps and provide financial or operational services to the credit union and its members (and occasionally other businesses and financial institutions). CUSOs are quite common in the credit union industry and play a significant role in helping financial institutions like ours expand their services and remain competitive against larger, more traditional banks. CUSOs provide services like insurance, financial planning, or innovative technology that we might not be able to offer directly as a not-for-profit institution. Their separate, for-profit structure allows us to focus on our members by adding valuable services and generating additional revenue without straining our internal resources. Four years after it launched, Advanced Reporting added comprehensive background screening to its list of services and welcomed customers from both the public and private sectors.

The year 1997 started with the opening of our fourth branch (the McNary Branch at 111 McNary Drive in Keizer, where it stands today). It ended with the opening of our first virtual branch, PC Branch, which allowed members to transfer money between accounts, apply for loans, balance their checkbooks, and check the Bluebook value of their cars.

Despite the growth, Maps (and other credit unions) faced legal challenges in 1997 as the U.S. Supreme Court prepared to rule on the interpretation of the AT&T Family Credit Union case and its involvement with the 1934 Federal Credit Union Act. The ruling could have forced millions of credit union members nationwide out of membership eligibility, but an overwhelming show of solidarity (including over 200 Maps members who gathered at the state capitol building in Salem) led to the passage of the Credit Union Membership Act, which was signed into law by President Clinton in August of 1998.

In 1998, we opened the Bearcat Branch, a mini branch at Willamette University that offered in-person services and a walkup ATM on the first floor of the campus’s Putnam Center (it closed in 2019). Our South Salem branch opened in November 1998 at Cherry City Plaza, 4615 Commercial Street SE. In 1999, another Student Branch was opened at McKay High School.

By 1999, Maps has 33,000 members and over $165 million in assets.

Stay tuned! Later this month, we’ll continue our deep dive into Maps history. Come back to learn about:

- One more name change

- Whether or not Maps survives the Y2K panic

- How the credit union transforms in the digital age

- What happens when longtime President and CEO Dan Penn retires

- How the credit union weathers a global pandemic and local wildfires

- What’s in store for the 90th anniversary

Want to learn more about the history and fundamentals of banking?

- Check out our article on how to kickstart your savings for National Savings Day.

- Learn the twisted history of the board game Monopoly.

- Find out what a central bank is and why it has so much influence on your mortgage rates.